Phishers steal personal information

Reports have been flooding in about phishing site fbstarter.com. The dummy web site poses as a Facebook login page to get users to type in their usernames and passwords.

Reports have been flooding in about phishing site fbstarter.com. The dummy web site poses as a Facebook login page to get users to type in their usernames and passwords.

We all know that online scams set to steal personal information such as passwords are the first step on the road to identity theft.

Phishers keep changing lure

You may recall just a couple of days ago when fbaction.net pulled exactly the same password-stealing scheme. Therein lies the problem. Facebook blocked fbaction.net and it has blocked fbstarter.com, but these scams were likely conducted by the same people.

That means these phishers are changing their scheme slightly and launching new attacks after one is thwarted.

Could be harmless — or not

The phishing scam is widely reported to be harmless. After all, fbstarter.com doesn’t ask for credit card information or account numbers so fraudsters could take out payday loans in your name. It just takes your user information so it can send annoying fraudulent messages to others that will bring them to fb starter.

However, if you use the same username and password on your Facebook page as you do to login to your bank account or pay your credit card bill, who knows what could happen?

What to watch for

This little scam works like this: You get an e-mail saying that you’ve got a message on Facebook. There’s a link so you can look at it. You click the link and it sends you to the dummy page, fb starter, which looks just like a Facebook login page. You attempt to login and voila, phishers have your password. ... click here to read the rest of the article titled "SCAM WATCH | fbstarter.com Steals Facebook Users' Passwords"

CLICK HERE if you missed the first part of this “Repair Your

CLICK HERE if you missed the first part of this “Repair Your  Welcome back to “Repair Your

Welcome back to “Repair Your

As you know from my other Free Earth Day Stuff article, there is no shortage of compact fluorescent light bulbs, canvas tote bags and goodies available at no charge on Earth Day.

As you know from my other Free Earth Day Stuff article, there is no shortage of compact fluorescent light bulbs, canvas tote bags and goodies available at no charge on Earth Day. Chrysler’s new Peapod car, which debuts today, is many things. It is electric, small and cute. However, it’s not really a car. Well, at least I don’t consider it a car. It’s a Neighborhood Electric Vehicle that only goes 25 miles per hour and can only travel 30 miles on a charge.

Chrysler’s new Peapod car, which debuts today, is many things. It is electric, small and cute. However, it’s not really a car. Well, at least I don’t consider it a car. It’s a Neighborhood Electric Vehicle that only goes 25 miles per hour and can only travel 30 miles on a charge. The world economic crisis has cut its path of woe everywhere. However, some countries have been effected more than others. Take Iceland as an example. Their recent economic meltdown,

The world economic crisis has cut its path of woe everywhere. However, some countries have been effected more than others. Take Iceland as an example. Their recent economic meltdown,  “Repair Your

“Repair Your  You’re back and you want to “Repair Your

You’re back and you want to “Repair Your  A recession is a recession is a recession. Money is tight and

A recession is a recession is a recession. Money is tight and  Dubbed America’s best by no less than the Wall Street Journal, the ghetto burger is ground beef, cheese, lettuce, tomato, bacon, seasoning, mayo, mustard, onions and chili on oven-toasted buns. When you look at your budget and cry out for that balm in Gilead, a ghetto burger will do nicely. ... click here to read the rest of the article titled "

Dubbed America’s best by no less than the Wall Street Journal, the ghetto burger is ground beef, cheese, lettuce, tomato, bacon, seasoning, mayo, mustard, onions and chili on oven-toasted buns. When you look at your budget and cry out for that balm in Gilead, a ghetto burger will do nicely. ... click here to read the rest of the article titled " I’ve previously mentioned in this

I’ve previously mentioned in this  We all talk about how we’re “addicted” to things. “Oh, I am so addicted to chocolate!” or “Have you seen how I look in those jeans? I am just ADDICTED to denim!” At this level, what we’re really saying is that we have a strong preference for certain things. However, when it comes to more serious things like

We all talk about how we’re “addicted” to things. “Oh, I am so addicted to chocolate!” or “Have you seen how I look in those jeans? I am just ADDICTED to denim!” At this level, what we’re really saying is that we have a strong preference for certain things. However, when it comes to more serious things like  You want to “Repair Your

You want to “Repair Your  Last time

Last time It’s always a good idea to be economical when it comes to food, whether there’s a recession on or not. If we need payday

It’s always a good idea to be economical when it comes to food, whether there’s a recession on or not. If we need payday  Welcome back, patriots! CLICK HERE if you missed part one of this article. As you’ll see here, illegal immigrants could use

Welcome back, patriots! CLICK HERE if you missed part one of this article. As you’ll see here, illegal immigrants could use

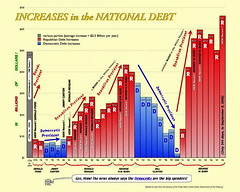

The early months of Barack Obama’s presidency have had everything to do with budgeting and spending. From delegating

The early months of Barack Obama’s presidency have had everything to do with budgeting and spending. From delegating  President Barack Obama’s stimulus plan extended unemployment benefits by five weeks through Federal Emergency Unemployment Compensation. Now, Minnesota is taking that extension even further through the state program, allowing up to 13 weeks of additional unemployment benefits after the EUC runs out.

President Barack Obama’s stimulus plan extended unemployment benefits by five weeks through Federal Emergency Unemployment Compensation. Now, Minnesota is taking that extension even further through the state program, allowing up to 13 weeks of additional unemployment benefits after the EUC runs out. The indictment against Rod Blagojevich will reportedly be filed later today. Though federal prosecutors have until Tuesday to produce and indictment regarding a “significant criminal matter,” they say it will be done today.

The indictment against Rod Blagojevich will reportedly be filed later today. Though federal prosecutors have until Tuesday to produce and indictment regarding a “significant criminal matter,” they say it will be done today.

Banks saddled with toxic assets have cried to the government for relief. They’ve received a

Banks saddled with toxic assets have cried to the government for relief. They’ve received a  When it comes to shopping, I’m sure you’ve found that everything continues to be expensive. Salaries are being cut all over and people are relying more on

When it comes to shopping, I’m sure you’ve found that everything continues to be expensive. Salaries are being cut all over and people are relying more on