Americans have finally gotten religion when it comes to savings. After dropping to 0 percent in recent years, the personal-savings rate jumped to more than 4 percent early in 2009.

Read more about Divvy Up Savings to Maximize Goals…

Americans have finally gotten religion when it comes to savings. After dropping to 0 percent in recent years, the personal-savings rate jumped to more than 4 percent early in 2009.

Read more about Divvy Up Savings to Maximize Goals…

Well, I sold my first stock. I agonized over when would be the right time, but then I just pulled the trigger, anyway.

Earlier this year, I started using the “free money” I was getting from this credit card to buy some stocks.

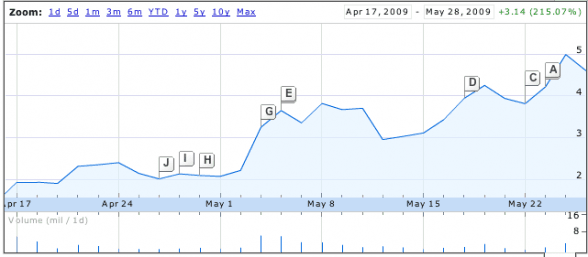

In March, we paid our tax bill of over $3,300 using that card, so the 2% rewards were higher than normal. I asked a friend of mine who knows a lot more about the stock market than me what stocks were catching her eye, and on her unofficial recommendation I bought 60 shares of CAR, the Avis car rental people.

That was April 17th. The stock price was $1.50. With a $9.95 commission at Sharebuilder, I ended up “spending” a total of $99.95.

And then I watched as the stock price just rose and rose and rose.

On about May 20th I started wondering if I should sell my proceeds. We’ve had rather more pet problems than usual and I was a little worried that our upcoming vacation might suffer as a result. The “overall return” on that investment, according to Google Finance, was hovering around 200%, which is a heck of a lot more than the 7 to 9% we’re taught to expect from long-term investments.

So I sold it on May 27th. I was a bit alarmed to see that there was yet another commission of $9.95. To me, that’s like paying a toll over a bridge going in each direction.

Stock proceeds: $282.24

Minus original investment of $99.95: $182.29

Now, if I’m reading this Capital Gains Tax table correctly, we’re going to be hit with a 25% of the “cost basis” come next April. If the cost basis is the amount I spent on the investment, that’d be the $99.95 number again, which means a tax of about $25.

Profit minus upcoming tax: $157.29

So I spent $99.95 and got $157.29, a real profit of 157%. Not the nearly 200% that Google Finance was teasing me with, but not shabby, either.

The other way to look at it is that since the $99.95 was free money in the first place, I made a profit of infinity dollars.

More importantly, when we take our vacation next month, we’ll have $157 that we otherwise wouldn’t have had. That’s one fancy dinner with some very good wine. I’m looking forward to it.

The Consumerism Commentary Podcast is in full swing with new episodes every Sunday. Listen and subscribe now!

Read more of Smithee's First Stock Sale…

In "Up," a house gets carried away by balloons.

I checked on Rotten Tomatoes today for ‘Up’ reviews, and sure enough, it looks like Pixar’s still got it. Any film that gets 97 percent positive reviews is sure to bring in massive amounts of cash at the box office.

I’m sure you’ll see some big numbers when it comes to same day cash after “Up” opens Friday. Here are some things critics had to say in their “Up” reviews:

“Up,” the latest lovely fantasy from the artists at Disney’s Pixar animation, it’s a truly fantastic adventure — a lighter-than-air daydream about a cranky widower (the voice of Ed Asner), a chubby boy and their amazing journey.

Things are looking Up. The buoyant Pixar escapade soars, and our hearts along with it. An optimistic tale about a pessimistic septuagenarian, this lovely film darts unpredictably between comedy and adventure, defying gravity and age.

How much do I love this movie? If it were mathematically possible, I’d give it five stars out of four.

This film is lovely in attitude and execution. In a world that sometimes seems filled with mean people, mean institutions and mean humor, "Up" is friendly, affirming and deeply moving. It's funny, too, but never at anyone's expense.

Pixar has proven itself, time and time again, to be a huge crowd-pleaser and moneymaker. Its first release, “Toy Story,” cost $30 million to make, and it nearly made back its production costs on its opening weekend in 1995, pulling in $29 million. ... click here to read the rest of the article titled "'Up' Reviews Show Pixar is Still a Powerhouse"

Chris M. sent me e-mail last week to share some thoughts on rewards checking and on credit unions. I’m a fan of both. In his message, Chris offered a handy tip for those of us who use credit unions instead of banks:

In reviewing your past posts, I realized that you might not know about something I use to get around going out of your way to the credit union all the time. I always work during banking hours, so I make all my deposits via ATM. I use a CU Service Center. The one I use has only two-day hold on deposits, like the credit union. Other credit unions may have five-day hold, which is not so nice. Here’s where I found my credit union service center.

Credit unions are a fantastic option for many people. They’re member-owned not-for-profit financial institutions that usually have strong ties to a local community. They tend to cooperate with each other instead of compete.

Despite the great rates and excellent service, credit unions do have drawbacks. Huge national banks provide hundreds (or thousands) of branches around the country, and there are often dozens within a single city. It’s easy to find help when you need it.

However, credit unions tend to be local. You’re not likely to find offices all over your city. I chose my credit union because it has two branches near my home, a branch near the family business, and two additional branches nearby. But if I’m on the other side of Portland and need to do some banking, there’s no office available.

Fortunately, most credit unions in the United States offer shared branching. It’s as if they’re all a member of one enormous banking network. The website Chris M. sent me last week offers a list of shared credit union service centers, making it easy to find a nearby credit union, even when you’re on the road.

—

Related Articles at Get Rich Slowly:

Read more about Credit Union Service Centers Provide Shared Branching…

Wall Street Journal columnist Scott McCartney says summer travel will be cheaper this year. McCartney pens the Journal’s weekly column “The Middle Seat.”

» E-Mail This » Add to Del.icio.us

Read more about Summer Travel Outlook: Sunny, Chance Of Bargains…

I wear them all winter long. This last winter, I bought so many scarves that I didn't know what to do with them. I like to color coordinate them with my outfit. Of course there is definitely a standard for the scarves that needs to be met. I also have made a few scarves before. It was actually kind of enjoyable. Everyone said that crocheting wouldn't be fun and that I would hate it but I don't. It actually keeps my quite calm. I can't wait till next winter when I can wear all my scarves.

I won. I won in my head anyway. I really had a lot of fun. We each had one pie and had to be the first person to finish eating it. I had a chocolate cream pie. I was hoping for more chocolate and less whipped cream but that wasn't the case. I ended up getting really sick after eating all of that whipped cream. I didn't even get a chance to get to the chocolate pudding. I started throwing up into a garbage can. I got disqualified after that. I guess they weren't too happy with seeing me puke my guts out.

I get a lot of e-mail from PR firms. I ignore most of it, but occasionally something stands out. One recent message invited me to make a trip to Orlando for the debut of The Great Piggy Bank Adventure, a new financial literacy exhibit at Walt Disney’s EPCOT Center.

At first, I was skeptical of the offer. As I’ve mentioned before, I’m wary of crossing the line to publishing advertorials. But after verifying that there were no expectations of coverage at GRS, I agreed to attend the launch. I’m a huge advocate of financial education, and this seemed promising.

“If I like the game, I’ll write about it,” I told Kris before we left. “But if I don’t, I won’t.”

I liked the game.

The Great Piggy Bank Adventure

The Great Piggy Bank Adventure is located in the Innoventions pavilion at EPCOT. Innoventions features exhibits that explore the practical applications of technology in everyday life. Each exhibit features a corporate sponsor. (Waste Management sponsors a recycling exhibit, Liberty Mutual sponsors a fire-prevention exhibit, etc.) The Great Piggy Bank Adventure is sponsored by T. Rowe Price, one of the “big three” no-load mutual fund companies, and a long-time supporter of financial literacy.

The Great Piggy Bank Adventure features five stations, each of which allows kids to play on their own, or work as a team with other kids or adults. (We saw lots of parents and grandparents joining the fun.)

Setting goals

You start The Great Piggy Bank Adventure by interacting with P.I.G. (your Personal Investment Guide) via a touchscreen video monitor. This animated porker asks you to set a savings goal (vacation, college, retirement, etc.), after which you open a drawer containing a physical piggy bank. This is a clever move on the designers’ part; people seemed to love carrying around their pigs.

Saving and spending

You carry your pig to the second station, place him inside a cubbyhole, and then play the first of a series of three videogames. The initial game explores the notions of saving and spending. Coins (representing your “income” from allowances, etc.) fall from the top of the screen, bouncing down from seesaw to seesaw before dropping into buckets at the bottom. These buckets contain labels like “outfits”, “mp3s”, and “savings”. Your goal is to direct as much money as possible into savings.

Meanwhile, your nemesis — the Big Bad Wolf — sneaks in and switches the buckets. The money you thought you were routing to savings might end up in the “outfits” bucket instead. You have to do your best to avoid the unexpected. When the game is finished, your physical pig appears on the other of the game console, “filled” with the virtual money you saved.

Inflation

The next game addresses inflation. (Inflation! In a children’s game!) Your pig climbs into a hot-air balloon, which you pilot around the screen, rising and falling with the air currents. As you move, you collect coins — but you have to work quickly. Again the wolf is your nemesis, and he’s decreasing your purchasing power with his evil coin-shrinking machine.

When this game is finished, the total you’ve collected is added to the amount you earned in the first game. You grab your pig and move to the next station.

Diversification

The final game tackles one of my favorite personal finance concepts: diversification. This is the best of the three games. It’s fun and it conveys the concept well.

Your pile of earnings is placed on the floor in the middle of a bedroom. Your goal is to hide the coins around the room: under the bed, in the drawers, behind a picture on the wall, etc. Each location is labeled with a multiplier (x2, x3, x4, etc.) that indicates how much your stash will increase — if it’s not stolen.

After a few seconds, the big bad wolf sneaks into the bedroom, cackling gleefully. He looks around and then chooses two spots to steal coins from. After he’s left with his loot, your remaining money increases based on the multipliers for each hiding spot. This process occurs three times, and then whatever is left is yours to keep.

Achieving goals

When the diversification game is finished, you pick up your P.I.G. one last time and carry him to the final station. You place him on a platform (from which he is whisked back to the beginning for somebody else to use), and then you receive an evaluation of your progress toward your goal.

I’m sorry to say that Kris and I made multiple attempts to meet financial goals, but always came up short.

Behind the Scenes

During the opening ceremony, I spoke with several representatives from T. Rowe Price and Disney. In fact, during our first pass through the game, Kris and I were accompanied by Stuart Ritter (a T. Rowe Price assistant vice president as well as a certified financial planner), who talked to us about the process of developing The Great Piggy Bank Adventure.

“How did you decide to do this?” I asked.

“Disney reached out to us and asked if we had a story we wanted to tell,” Ritter said. “That was over three years ago. We had to sit down and decide what fundamental financial concepts we wanted to convey to an audience that was between 8 and 14 years old.”

Ritter’s colleague, Edward Giltenan, chimed in. “The idea of investing is not just to make money. How much you save has a much bigger impact than anything else. What you invest in isn’t as important as that you invest. Everything matters, but some things matter more. One thing that will always always affect your outcomes is saving more — and that’s something you can control.”

Ritter and Giltenan explained that the goal of T. Rowe Price was to produce a game that would introduce children to these concepts, and to spur conversation between kids and parents.

“Did T. Rowe Price actually design the game?” I asked.

“No,” said Ritter. “It was a collaborative process. Once we understood the concepts of the story, we began to work with the Disney Imagineers to figure out a way to convey these ideas.”

To learn more about the design process, I spoke with Anne Kelly, the Walt Disney Imagineer who led this project. Kelly, who trained under Randy Pausch, explained how her group tried to convey complex subjects like inflation and diversification.

“We tried to follow the fun,” Kelly said. “We asked ourselves how we could take an abstract concept like money and make it tangible and hands-on. For example, the wolf represents something different in each game. In the savings game, he stands for impulse purchases. In the inflation game, he’s, well, inflation. And in the diversification game, the wolf represents risk.”

Evaluation

I’ve encountered a lot of financial education products, but, to be honest, most of them seem rather lame. That’s not the case with The Great Piggy Bank Adventure. I think that T. Rowe Price and Disney have done an excellent job of introducing complicated subjects in a way that makes sense. However, I’m not sure they’ve reached their target audience. Over two days at EPCOT, Kris and I had a chance to watch many families play the game. Few of these families contained the targeted 8-14 year olds. Instead, the game appealed to younger kids. (These kids loved carrying their pigs.)

While these children are too young to understand the concepts explored in The Great Piggy Bank Adventure, Kris and I did observe an interesting side-effect. As the parents helped their youngsters play, the adults were gleaning information. (The diversification game, especially, seemed to cause some flashes of insight.)

“So is the game just a big pitch for T. Rowe Price?” our friends asked us at brunch last weekend. They were skeptical of the concept, just as we had been at first. “Are they just trying to get parents to buy T. Rowe Price products?”

“Actually, no,” said Kris. “In fact, I don’t remember seeing much about T. Rowe Price at all.”

“There’s a little bit of branding here and there,” I said, “but really it’s innocuous. You know how much we hate advertising. But we actually thought Disney should have been selling T. Rowe Price piggy banks or something.”

“Yeah,” Kris said. “EPCOT is filled with so much other merchandise. It would have been good to see kids buying a T. Rowe Price piggy bank instead of mouse ears or Goofy shirts. They’re missing a huge opportunity there. People who played the game loved carrying around their pigs!”

I had some trepidation about making this trip. I don’t want to cross the line to advertorials. Ultimately, I had to ask myself: “How would I have felt about this exhibit if I had stumbled upon it at random during a trip to EPCOT made at my own expense?” The answer to that is easy: I would have been delighted to find a bastion of financial common sense in the midst of this merchandising machine, and I would surely have written about it.

For more info on this new exhibit:

If you plan to be at EPCOT this summer, head over to Innoventions and check out The Great Piggy Bank Adventure!

—

Related Articles at Get Rich Slowly:

Read more about The Great Piggy Bank Adventure…

Time is running out for General Motors Corp. to either restructure or file for bankruptcy protection under Chapter 11. The U.S. automaker faces a Monday deadline set by the federal government to decide. With the bankruptcy option looking more likely, will additional taxpayer money be at risk?

» E-Mail This » Add to Del.icio.us

Read more about Q&A: How Will GM Stay In Business?…

Would there be any use for airplanes or cars at all anymore? Would everyone be able to fly or just certain people? What kind of laws would there be in place for those who could fly? How far would we be able to fly before getting exhausted. It would be interesting to see how technology would change if we could fly. I wonder if we would be able to fly out of earth’s atmosphere or if we would have to stay in it. It would be amazing if we could fly into space under our own will power. I would like exploring other planets and galaxies and I’m sure there are many others who would like to also.

The California Supreme Court has made a much-anticipated ruling on the rights of individuals to marry. Their decision was to uphold the state’s previous Prop 8 decision to ban gay marriage.

John Schwartz reports for the New York Times that the California Supreme Court decision on Prop 8 runs counter to a growing trend in other states that allow the practice. Future marriages of this nature will not be allowed in California after this ruling, but couples already married in the state before the Proposition 8 ruling will retain their married status. There were 18,000 same-sex couples married in California between May 2008 (when gay marriage was made lawful) and November 2008 (when Proposition 8 was initially passed).

California currently will allow civil unions, which according to Chief Justice Ronald George grants the ability to “choose one’s life partner and enter with that person into a committed, officially recognized and protected family relationship that enjoys all of the constitutionally based incidents of marriage.” The argument is that civil union essentially grants couples all the same rights as those who are married, but there is far from universal agreement on this matter. Among other things, there are questions as to whether certain types of insurance apply to both individuals in a domestic partnership, and whether financial matters like wills, tax provisions and pension benefits work in a similar fashion. In terms of short-term consumer finance, however, access to a loan company or fulfilling the “I need my cash now” requirement are not restricted in any way by the California Supreme Court decision on Prop 8. ... click here to read the rest of the article titled "California Supreme Court Upholds State's Prop 8 Decision"

Delta and Northwest Airlines are merging, and right now you can go ahead and transfer frequent flier miles between the Northwest WorldPerks and Delta SkyMiles programs with no fees. You can even move them back and forth as you like. This is nice if you don’t have enough of either individually to get an award, but after combining you do. Also, if you link your Northwest and Delta accounts by May 31st, you’ll get 500 bonus miles.

According to this timeline, they will eventually all be merged into SkyMiles anyway in December 2009.

Read more about Transfer Between Delta and Northwest Frequent Flier Miles…

Health drinks are generally soft drinks which are made to provide the adequate energy and stamina to men. A qualitative health drink contains methylsxanthines, caffeine and sufficient percentage of vitamin B complex including other herbal components. There is also the availability of carnitine, creatine, glucuronolactone, ginkgo biloba maltodestrin and inositol. However coca is available in this health drink as an essential ingredient. It is also seen that this ingredient in the form of verba mate is also used in making chocolates. The majority of young and oldies show much inclination towards this type of the energy enhancer. This health drink helps people to be healthy and resolute. Daily intake of such health drinks is conducive to build body and mind. Lastly, coffee is not generally thought to be the proper health drink product. However, according to health consultants, coffee can reduce the severity of many diseases like diabetes and heart attack. It contains antioxid ant element which eliminates the damage of the cellular structure.

We don’t recommend you try to time the housing market but, if you’re in the market for a new home, it helps to pay attention to its cyclical nature. When times are hard, prices drop and the market becomes more attractive. When more people get in, prices naturally rise. While there are still deals to be had, this map shows that some of the regions that were hit hardest by the housing crisis in 2007 and 2008 have begun to bounce back in early 2009 with increased sales numbers. With sale prices of homes plummeting as much as 50% in some regions, more people have been jumping into the market with hopes of getting a great deal, especially with 30 year fixed rates falling below 5% for the first time in recent memory. The metropolitan areas that are highlighted are those with the highest percentage of change in median sales prices, for better or worse. The highest percentage increases in home sales are in areas where prices have dropped the most over the past year, wh ich is an encouraging sign as bargain hunters see new opportunities. Further, the decrease in prices and attractive housing credits have finally made it possible for many first-time homebuyers to afford a home in the once red-hot areas like Orange County, Phoenix, and Las Vegas. While there are only six states that have experienced increases in sales volume in the past year, most of those positive changes have been drastic. Arizona has seen a 50% jump, California over 80% and Nevada an impressive 117% increase from 2008. Depending on where you live, the housing market may be in either a boom or bust cycle. Let us know in the comments how real estate is looking in your hometown, whether it is on the map or not.

Click to enlarge the map below:

Read more about Mint Map: Real Estate By State…

She turned six and it was her birthday present. We painted it purple and pink. Those happen to be her two favorite colors. We painted the whole room a light pink. After painting that, we painted a couple squares of purple. The purple was magnetic paint. I had never heard of it before but use it now in my nieces bedrooms. It makes the wall magnetic so that kids can put magnets on their wall. It is much easier than putting a whole bunch of holes in the wall. We put pink and purple butterflies in the corners of everything. She really loves it and I am proud of my work.

I can't believe that they took it off of the list of planets. When my kids learn about planets in school, their teachers aren't even going to teach them about Pluto. I remember I used to be so excited to learn about it every time it came up in class. I wish my children knew about it. I think I am going to just have to teach them myself. It might be interesting trying to explain to them that there is another planet called Pluto when their teachers in school are telling them the opposite of that. I hope I don't confuse them too bad with my teachings.

I wish I could be an astronaut and go to outer space. It would be amazing! I would get to wear one of those awesome helmets that keep the oxygen in so I wouldn't suffocate. I would also get to float in air instead of having gravity on me all the time. It would be the coolest thing ever. I would get to walk on other planets. That would be amazing to be able to experience that. I think that maybe I am going to have to find a way into NASA so that I can become a part of this amazing space program. I will have to put that on my bucket list so that I can do it before I die.

President Obama on Friday signed into law a bill that will restrict how credit card companies can raise interest rates and charge fees. The legislation, written by Sen. Christopher J. Dodd (D-Conn.), also forces companies to simplify terms and conditions of contracts. Analysts said the law will t…

Read more about Change Is Coming to Your Wallet…

Robert Reynolds has been president and chief executive officer of Putnam Investments since the middle of last year. He recently chatted with a group of Kiplinger’s editors:

Read more about Putnam Chief Says Worst Is Likely Over…

Sometimes it’s so satisfying to find some small money leak that you can fix. I realized that just didn’t need my weekend newspaper delivery any more– I tend to be with Sweetie, and by the time I’m back at my place, the papers have been thrown out or stolen and I’ve already read Sweetie’s copy. So why keep paying for that?? I switched to a Monday-Friday subscription. A few dollars a week may not seem like much, but it adds up over time, and why waste any money, however small the amount?

But how much money did I actually save? Here’s an interesting tidbit I discovered along the way. According to the Times’ website, the regular, undiscounted price for a 7-day a week subscription price is supposedly $21.20–the website quotes a $10.60 per week price but says it increases to the regular price after an introductory 12-week period. The Monday-Friday price is $11.20 ($5.60 intro). The Saturday-Sunday-only price is $11.40 a week ($5.70 intro). But I have only been paying $42.40 a month, or I guess every 4 weeks, as that is 4X the $10.60 rate above. I’m well past any initial promotional rate, so I don’t know why this is the case. But it means my savings for canceling weekends is actually only $5. But at least I am still paying less than the cover price, which is $1.50 Monday-Saturday, and $5 on weekends, which comes to $14 a week. (The Times rece ntly announced they’ll raise the price to $2/$6 as of June 1, though home delivery prices supposedly won’t change just yet.)

In any case, my original point still holds: it’s nice to save a few bucks, however you can!